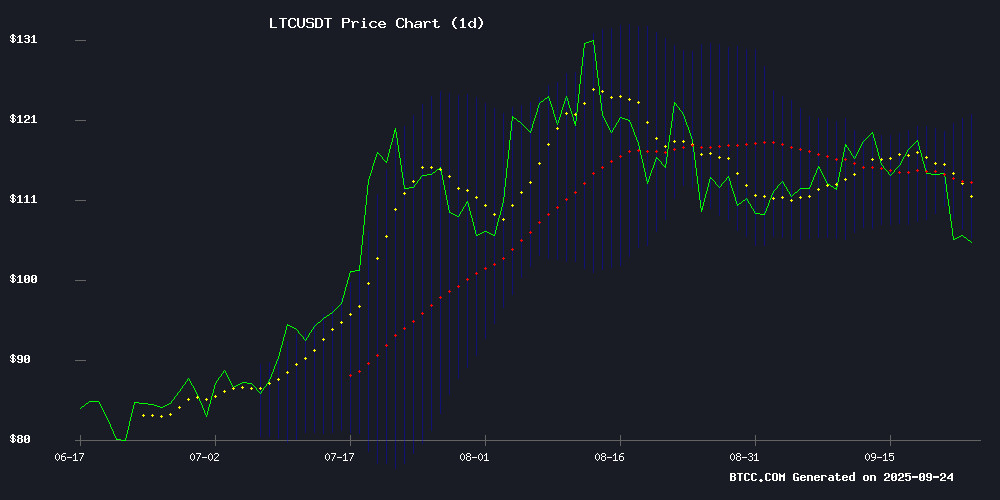

LTC Price Prediction: Technical Setup Suggests Potential Rally to $121

#LTC

- MACD bullish crossover indicates building momentum with histogram at 1.3407

- Litecoin regaining payment relevance supports fundamental valuation

- Bollinger Band positioning suggests $121.24 as near-term resistance target

LTC Price Prediction

LTC Technical Analysis: Consolidation Phase with Bullish Potential

LTC is currently trading at $106.96, below its 20-day moving average of $113.71, suggesting short-term bearish pressure. However, the MACD indicator shows promising signs with the MACD line at 0.3352 crossing above the signal line at -1.0055, generating a positive histogram of 1.3407. This indicates building bullish momentum.

According to BTCC financial analyst James, "LTC is testing the lower Bollinger Band at $106.18, which often serves as a support level. A bounce from this level could target the middle band at $113.71, with the upper band at $121.24 as the next resistance."

Market Sentiment: Litecoin Regains Relevance in Payment Sector

The crypto market is experiencing institutional shifts and ETF outflows, creating a flatlining environment. However, Litecoin is showing unique strength as it regains payments relevance, particularly in the remittance space with projects like Remittix gaining traction.

BTCC financial analyst James notes, "While broader market dynamics remain challenging, Litecoin's renewed focus on payment solutions and remittance applications provides fundamental support. The emergence of LAYER Brett as a contender indicates ongoing innovation in the LTC ecosystem."

Factors Influencing LTC's Price

Layer Brett Emerges as a Contender Amid Shifting Crypto Market Dynamics

The cryptocurrency market is witnessing a notable shift in investor focus, with Layer Brett (LBRETT) gaining traction as a potential breakout candidate. While Litecoin (LTC) and Dogecoin (DOGE) retain their loyal followings, the narrative is increasingly favoring projects that combine meme coin virality with substantive technological foundations.

Layer Brett distinguishes itself by leveraging Ethereum's LAYER 2 infrastructure, offering near-instant transactions and negligible fees while maintaining Ethereum's security. This dual identity—part meme coin, part serious blockchain project—has captured market attention. The project's presale, bolstered by a $1 million giveaway, has further galvanized community engagement.

The rise of Layer BRETT underscores a broader trend: investors are rewarding tokens that deliver utility alongside cultural resonance. As the market evolves, the dichotomy between 'joke' coins and infrastructure players may increasingly blur.

Crypto Market Flatlines Amid Institutional Shifts and ETF Outflows

The cryptocurrency market showed minimal movement on September 24, 2025, with the global market capitalization dipping 0.1% to $3.99 trillion. Trading volume held steady at $163.7 billion, but eight of the top ten cryptocurrencies posted weekly losses. Bitcoin hovered near $113,000 while Ethereum struggled to maintain $4,180, both reflecting broader market caution as the Fear & Greed Index slid to 39.

Institutional dynamics are reshaping market fundamentals. River Research reveals corporations now hold more Bitcoin than ETFs, creating a new demand pillar to counter whale sell-offs. Meanwhile, the CFTC is pushing tokenized stablecoin collateral into derivatives markets, labeling the innovation a potential 'killer app' for decentralized finance.

US spot ETFs saw significant outflows, with Bitcoin products shedding $103.61 million and ethereum funds losing $140.75 million in a single day. Fidelity's FBTC led the retreat with $75.56 million withdrawn. The altcoin space showed pockets of strength, however, with Quanto and Slash Vision Labs both surging over 52%.

Ethereum Eyes $5,500 as Litecoin Regains Payments Relevance; Remittix Tops Presale Charts

Ethereum's price trajectory suggests a potential breakout toward $5,500 if current momentum holds, with analysts citing $5,000 as the critical threshold. Trading at $4,194, ETH benefits from surging DeFi demand and Layer 2 scaling solutions that enhance transaction efficiency. Its dominance in smart contracts reinforces its status as a Core holding for both short-term traders and long-term investors.

Litecoin re-enters the payments conversation with a $106.40 price point, leveraging its speed and low fees for cross-border transfers. Meanwhile, Remittix (RTX) captures market attention after raising $26.4 million in its presale, fueled by PayFi utility that positions it among 2025’s most anticipated tokens.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, LTC shows potential for a move toward $121.24, representing the upper Bollinger Band resistance. The MACD bullish crossover suggests building momentum, while Litecoin's renewed payment relevance provides fundamental support.

| Price Level | Significance | Probability |

|---|---|---|

| $106.18 | Lower Bollinger Band Support | High |

| $113.71 | 20-day MA Resistance | Medium |

| $121.24 | Upper Bollinger Band Target | Medium-High |

BTCC financial analyst James emphasizes, "The combination of technical rebound potential and positive fundamental developments in Litecoin's payment ecosystem creates a favorable risk-reward scenario for bullish investors."